Understanding Your Income/Residence Tax Saving and Overpaid Refund in Japan

Understanding Your Japanese Income/Residence Tax Saving and Overpaid Refund

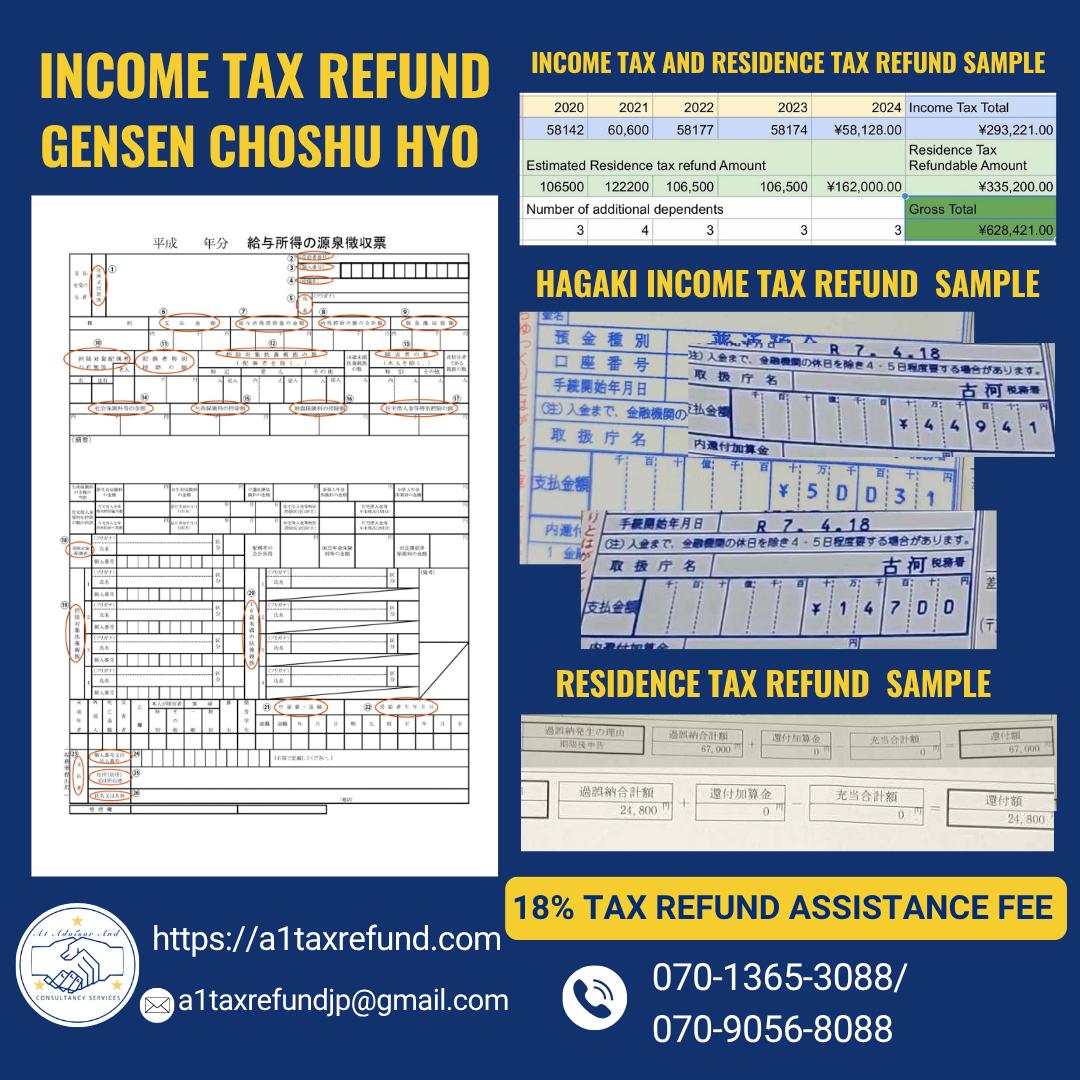

The tables provided details the estimated annual tax savings in Japan for taxpayers who claim various dependent categories (and the Spouse Deduction/Disability Deduction). They clearly illustrate the core difference between the two main types of tax savings: National Income Tax (variable) and Local Resident Tax (fixed).

Key Components of the Tax Saving Tables

1. National Income Tax Refund (The Variable Component)

This tax saving varies significantly based on your marginal tax rate (your income bracket). This saving is the primary mechanism for receiving a tax refund if you have had too much tax withheld from your salary (Year-End Adjustment or Final Tax Return).

- Calculation:Tax Deduction Amount Your Income Tax Rate (5%, 10%, 20%, 23%, etc.)

- Observation:The tables clearly show that the higher your income bracket, the larger the actual Yen amount of the Income Tax saving, even though the base deduction amount is the same. For instance, the deduction saves a taxpayer at the bracket but at the

2. Local Resident Tax Saving (The Fixed Component)

This tax saving is fixed regardless of your National Income Tax bracket. It reduces your yearly local tax liability, which is typically paid in 12 monthly installments (or 4 quarterly installments).

- Resident Tax is

Summary of Tables by Category

- General Dependentand Spouse Deduction (Max): These categories share the same Income Tax savings because they both rely on the 380,000 National Tax Deduction amount.

- Specified Dependent (19-23):This category provides the highest savings due to the significantly higher 630,000 National Tax Deduction amount.

- Disability Deductions:These are unique as they are tied to the individual’s status rather than their age/relationship. They offer distinct savings based on the level of disability ( for Standard, for Special, etc.).

Detailed breakdown of Income Tax Saving and Resident Tax Saving for all major dependent types (General, Specified, Elderly – Cohabiting, and Elderly – Non-Cohabiting if applicable, plus Standard Disability) across the 5%, 10%, 20%, and 23% income tax brackets.

Dependent Type: General Dependent

- Fixed Resident Tax Saving: ¥33,000 (¥330,000 deduction x 10%)

- Income Tax Deduction Amount: ¥380,000

|

Income Bracket |

Income Tax Saving (Variable) |

Resident Tax Saving (Fixed) |

Total Saving |

|

5% |

¥19,000 (¥380,000 x 5%) |

¥33,000 |

¥52,000 |

|

10% |

¥38,000 (¥380,000 x 10%) |

¥33,000 |

¥71,000 |

|

20% |

¥76,000 (¥380,000 x 20%) |

¥33,000 |

¥109,000 |

|

23% |

¥87,400 (¥380,000 x 23%) |

¥33,000 |

¥120,400 |

Dependent Type: Specified Dependent (19-23 years old)

- Fixed Resident Tax Saving: ¥33,000

- Income Tax Deduction Amount: ¥630,000

|

Income Bracket |

Income Tax Saving (Variable) |

Resident Tax Saving (Fixed) |

Total Saving |

|

5% |

¥31,500 (¥630,000 x 5%) |

¥33,ooo |

¥64,500 |

|

10% |

¥63,000 (¥630,000 x 10%) |

¥33,000 |

¥96,000 |

|

20% |

¥126,000 (¥630,000 x 20%) |

¥33,000 |

¥159,000 |

|

23% |

¥144,900 (¥630,000 x 23%) |

¥33,000 |

¥177,900 |

Dependent Type: Elderly Dependent (70+ years old) – Cohabiting

- Fixed Resident Tax Saving: ¥33,000

- Income Tax Deduction Amount: ¥480,000

|

Income Bracket |

Income Tax Saving (Variable) |

Resident Tax Saving (Fixed) |

Total Saving |

|

5% |

¥24,000 (¥480,000 5%) |

¥33,000 |

¥57,000 |

|

10% |

¥48,000 (¥480,000 x 10%) |

¥33,000 |

¥81,000 |

|

20% |

¥96,000 (¥480,000 x 20%) |

¥33,000 |

¥129,000 |

|

23% |

¥110,400 (¥480,000 x 23%) |

¥33,000 |

¥143,400 |

Dependent Type: Elderly Dependent (70+ years old) – Non-Cohabiting

- Fixed Resident Tax Saving: ¥33,000 (¥330,000 deduction x 10%)

- Income Tax Deduction Amount: ¥380,000

|

Income Bracket |

Income Tax Saving (Variable) |

Resident Tax Saving (Fixed) |

Total Saving |

|

5% |

¥19,000 (¥380,000 x 5%) |

¥33,000 |

¥52,000 |

|

10% |

¥38,000 ($¥380,000 x 10%) |

¥33,000 |

¥71,000 |

|

20% |

¥76,000 ($¥380,000 x 20%) |

¥33,000 |

¥109,000 |

|

23% |

¥87,400 ($¥380,000 x 23%) |

¥33,000 |

¥120,400 |

Additional Fixed Savings (Resident Tax Only)

These categories typically do not have a separate National Income Tax deduction but provide a fixed Resident Tax saving.

- Standard Disability:

- Resident Tax Saving: ¥26,000 (Fixed)

- Note: There is also an Income Tax deduction for disability, but the value varies based on the severity (standard, special, or severe cohabiting). For simplicity and fixed “At-a-Glance” context, ¥26,000 is often cited for Resident Tax.

Below is a table that consolidates the maximum potential Income Tax Saving (which determines the refund on overpaid tax) for each dependent category across the four requested income tax brackets. This saving excludes the fixed Resident Tax portion.

The maximum potential Income Tax Saving (the amount contributing to a refund) is calculated by multiplying the deduction amount by your marginal tax bracket percentage.

Income Tax Refundable for Overpayment by Tax Bracket (National Tax)

|

Tax Bracket |

General Dependent (¥380k Deduction) |

Specified Dependent (19-23) (¥630k Deduction) |

Elderly Dependent (70+, Cohabiting) (¥480k Deduction) |

Spouse Deduction (Max ¥380k Deduction) |

Standard Disability (¥270k Deduction) |

Special Disability (¥400k Deduction) |

|

5% |

¥19,000 |

¥31,500 |

¥24,000 |

¥19,000 |

¥13,500 |

¥20,000 |

|

10% |

¥38,000 |

¥63,000 |

¥48,000 |

¥38,000 |

¥27,000 |

¥40,000 |

|

20% |

¥76,000 |

¥126,000 |

¥96,000 |

¥76,000 |

¥54,000 |

¥80,000 |

|

23% |

¥87,400 |

¥144,900 |

¥110,400 |

¥87,400 |

¥62,100 |

¥92,000 |

Disability Deduction Notes:

- Standard Disability: Uses a ¥270,000 National Tax Deduction.

- Special Disability: Uses a ¥400,000 National Tax Deduction.

- Special Disability (Same Household): Note that there is a highest tier for a Special Disability living in the same household, which has a ¥750,000 deduction, offering even greater savings than the Specified Dependent category.

Key Takeaways for Income Tax Saving:

- The Power of the Bracket: For a Specified Dependent, moving from the 5% bracket to the 23% bracket increases the Income Tax saving by over 5 times (from ¥31,500 to ¥144,900).

- Deduction Size Matters: The Specified Dependent (with a ¥630,000 deduction) provides the largest saving across all brackets, demonstrating the high value placed on supporting students in that age group.

- Non-Cohabiting Similarity: The General Dependent and the Elderly Dependent (Non-Cohabiting) provide identical Income Tax savings because they both utilize the same base National Income Tax Deduction amount of ¥380,000.

Fixed Annual Resident Tax Saving for each dependent category.

Unlike the Income Tax saving, the Resident Tax saving does not vary by your income bracket because the local Resident Tax rate applied to the deduction is a fixed 10%.

Fixed Annual Resident Tax Saving (Local Resident Tax)

Dependent Category Fixed Annual Resident Tax Saving

All Dependents ¥33,000Key Takeaways for Resident Tax Saving:

- It’s Guaranteed: This saving is fixed regardless of your National Income Tax bracket (5%, 10%, 20%, etc.), providing a constant minimum benefit.

Information arranged in tables forms are from the (NTA) National Tax Authority Website in Japan.