Japan Income & Residence Tax Refund Blueprint (2020–2024): Maximize Claims via Remittance and Gensen Criteria

Japan Income & Residence Tax Refund Blueprint (2020–2024): Maximize Claims via Remittance and Gensen Criteria

✨ Introduction

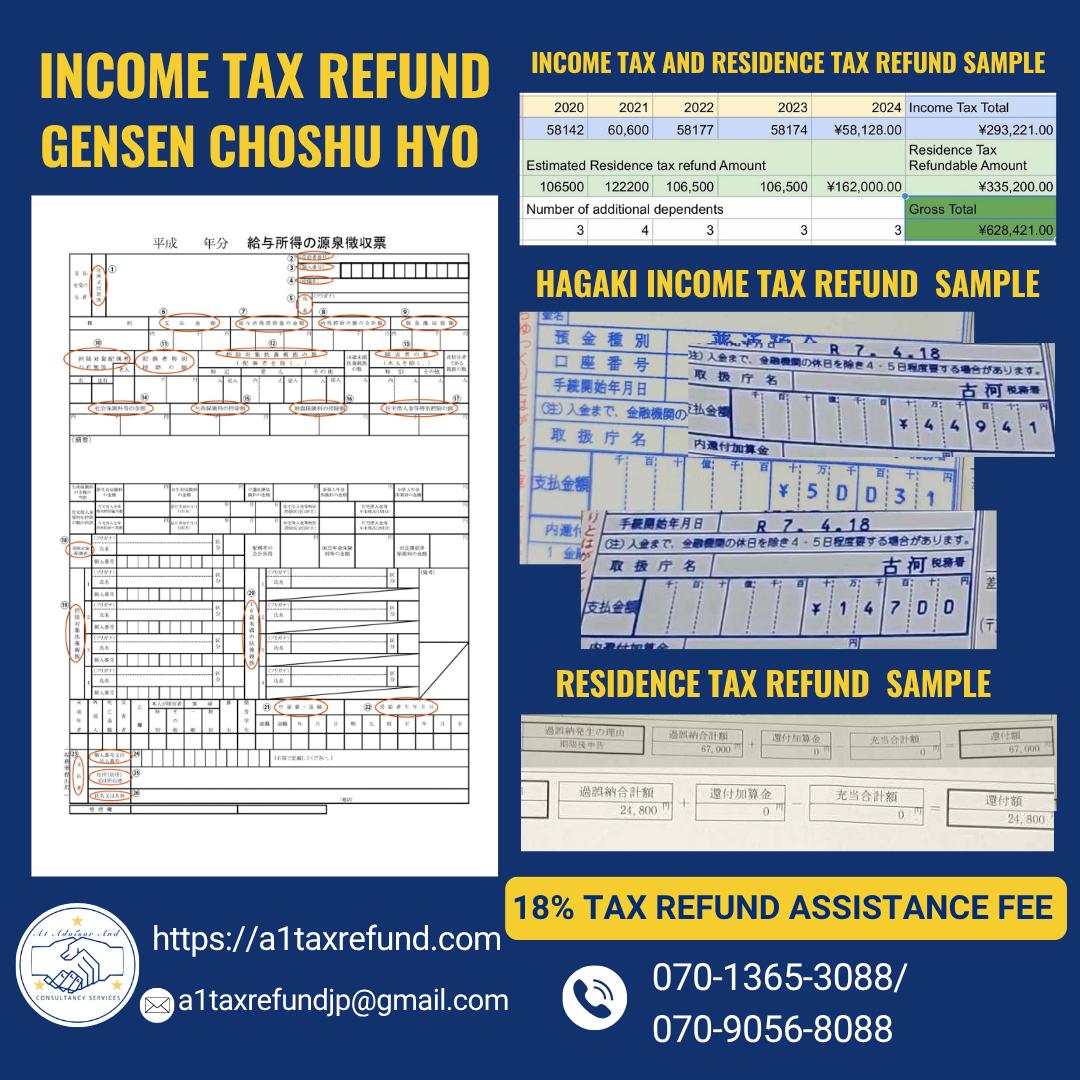

Navigating Japan’s income and residence tax refund system can be complex—especially for residents supporting family members abroad. This article serves as a comprehensive guide to maximizing eligible refund claims between 2020 and 2024. Whether you’re a foreign resident, consultant, or financial advisor, understanding the required documentation and government criteria is crucial.

The Japanese National Tax Agency (NTA) offers specific deductions through Gensen Choshuhyo reports and verified remittance to eligible dependents. When properly documented, you can reclaim significant amounts retroactively—sometimes for up to five years.

Below is the official blueprint, maintained with complete accuracy:

1. Gensen Choshuhyo Qualification

Your Gensen Choshuhyo must meet these criteria:

- Issued for one or more tax years between 2020 to 2024

- Includes:

- Name of employer and recipient

- Annual income

- Taxes withheld

- Employer’s corporate number and tax office jurisdiction

- Beneficiaries appearing on the Gensen cannot be declared as beneficiaries for tax refund.

- 🟢 If available, contact A1 Advisor and Consultancy Services at a1taxrefundjp@gmail.com or call 070-1365-3088 / 070-9056-8088 Up to 5 years retroactively from the following January 1

2. 💸 Remittance Qualification for Dependents (Based on Age Bracket) To claim dependents living abroad, you must present:

Proof of regular remittance for each year

Documents showing relationship (e.g., birth/marriage certificates)

Remittance receipts or passbook entries

Beneficiaries must meet age and income conditions per NTA guidelines:

a. For Years 2020–2022

| Age Group | Income Limit | Refund Estimate / Year | Notes |

|---|---|---|---|

| Under 16 | Not required | ¥54,800 | Any dependent under 16 |

| 16–29 | < ¥380,000 | ¥54,800 | Must be financially supported |

| 30–69 | < ¥380,000 | ¥54,800 | Same as above |

| 70+ | < ¥380,000 | ¥54,800 | Same as above |

| Students 19–22 | < ¥380,000 + full-time proof | Up to ¥75,000 | Certificate of enrollment required |

| Disabled Person | Any income | Up to ¥140,000 | Based on classification |

| Spouse (living together) | < ¥380,000 | ¥54,800 | Must share household address |

| Widow / Single Parent / Working Student | — | Additional deductions apply | Certificate may be required |

b. For Years 2023 Onward (Updated Brackets)

| Age Group | Income Limit | Refund Estimate / Year | Notes |

|---|---|---|---|

| Under 16 (own child only) | Not required | ¥54,800 | Must be biological or adopted child |

| 16–29 | < ¥480,000 | ¥54,800 | Proof of financial dependence needed |

| 30–69 | < ¥480,000 | ¥54,800 | Same as above |

| 70+ | < ¥480,000 | ¥54,800 | Same as above |

| Students 19–22 | < ¥480,000 + full-time proof | Up to ¥75,000 | Certificate required from overseas school |

| Disabled Person | — | Up to ¥140,000 | Based on severity and living situation |

| Spouse (living together) | < ¥480,000 | ¥54,800 | Joint address confirmation required |

| Widow / Single Parent / Working Student | — | Additional deductions apply | Must submit declaration form |

Income is measured as net taxable income excluding non-taxable pension, capital gains from listed shares, or interest under special tax treatment.

3. Required Documentation Checklist •

✅ Gensen Choshuhyo (2020–2024)

✅ Remittance Receipts or Passbook Copies

✅ Relationship Proofs: Birth certificates, marriage contracts

✅ Residence Card (Japan)

✅ My Number

✅ Student Enrollment Certificate (if claiming student deduction)

✅ Disability Certificate (if applicable)